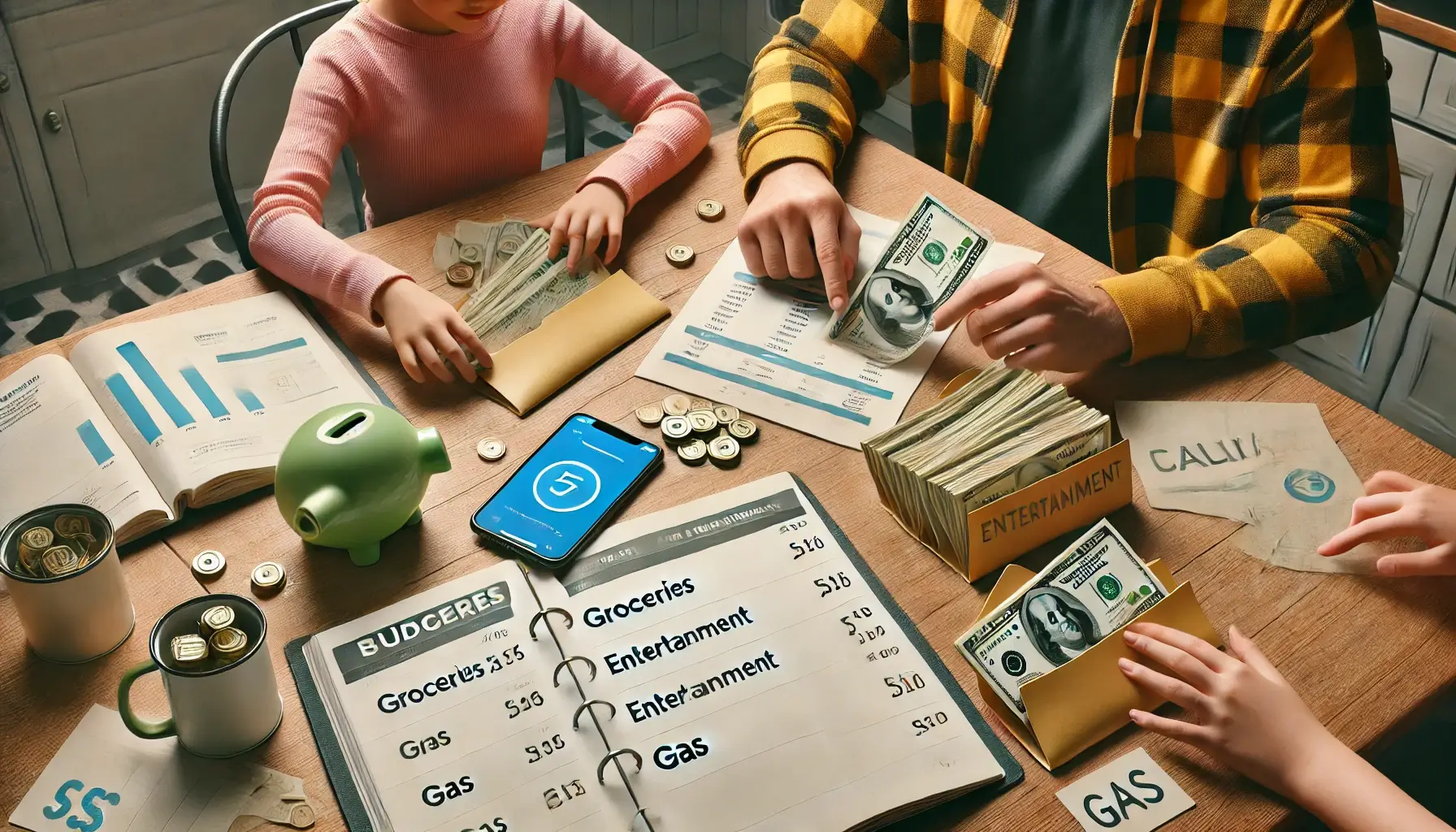

When it comes to managing a family budget, sometimes the simplest systems are the most effective. That’s why the envelope method — or its modern version using digital wallets — remains one of the most powerful tools for controlling spending.

This approach helps you stick to your budget, avoid overspending, and understand exactly where your money goes. And the best part? It’s easy for the whole family to learn and use.

Here’s how to use both physical envelopes and digital wallets to take full control of your household expenses.

1. What Is the Envelope System?

The envelope system is a budgeting method where you divide your money into categories and assign each one its own envelope filled with cash.

Example envelopes:

- Groceries

- Gas

- Dining out

- Entertainment

- Kids’ expenses

- Pet care

- Personal spending

Once the money in an envelope is gone, spending in that category stops until the next budgeting cycle.

2. Who Should Use This Method?

This system is ideal for:

- Families trying to control variable spending

- People who struggle with card swipe habits

- Households on a cash-based budget

- Anyone wanting to visualize and feel their money more tangibly

It’s especially great for categories where overspending tends to happen — like groceries, restaurants, or impulse buys.

3. How to Set It Up (Physical Envelopes)

Step-by-step:

- Decide your categories – Focus on flexible spending areas, not fixed bills.

- Determine your budget for each envelope.

- Label each envelope clearly.

- Fill each one with cash at the beginning of the month (or each paycheck).

- Spend only from that envelope for its purpose — and stop when it’s empty.

💡 Tip: Store envelopes in a safe place or use a wallet with dividers if you carry them around.

4. What If You Prefer Digital? Try “Digital Envelopes”

Many apps now let you use the envelope method without using physical cash.

Top digital envelope apps:

- Goodbudget

- Mvelopes

- YNAB (You Need a Budget)

- EveryDollar

These apps let you assign spending limits to each category and track every transaction in real time — all from your phone or desktop.

5. How to Use Digital Envelopes as a Family

Digital tools make it easy to involve multiple family members.

How to stay organized:

- Share login access (if safe and appropriate)

- Assign each person or couple certain categories

- Sync app with bank accounts for auto-tracking

- Review weekly together and adjust if needed

Some apps even let you export reports to visualize spending over time.

6. Set Rules to Make the System Work

No matter which method you use, rules help the system stick.

Suggested rules:

- No borrowing from other envelopes without agreement

- When it’s gone, it’s gone — no top-ups mid-cycle

- Everyone logs their spending daily or weekly

- Review and reset envelopes at the end of each month

These guidelines keep the system from getting messy — and promote accountability.

7. Involve the Whole Family (Even Kids)

Budgeting isn’t just for adults — it’s a family habit.

Ideas to include children:

- Give kids their own mini envelopes or digital categories (e.g., fun money, savings, gifts)

- Let them track progress with stickers or drawings

- Talk about what each envelope means

- Teach the value of waiting, saving, and choosing

This builds money awareness from an early age.

8. Adjust Categories as You Learn

Your first envelope setup won’t be perfect — and that’s okay.

Each month, ask:

- Did we underfund or overfund any categories?

- Are there any unnecessary categories?

- Do we need to add one for a new expense?

- Are our goals and habits reflected in this system?

Budgeting is dynamic — let your envelope system evolve with your life.

9. Combine Envelopes with Other Budgeting Methods

Envelopes work best when part of a larger strategy.

Combine with:

- A monthly budget plan

- A sinking fund system for bigger goals

- A visual tracker for savings or debt

- Calendar reminders for envelope resets

This creates a complete financial routine with minimal stress.

10. Track Progress and Celebrate Wins

Celebrate when you:

- Stick to every envelope category

- Cut back in a problem area

- Save leftover money at the end of the month

- Hit a spending or saving milestone

Budgeting should feel empowering — not restrictive.

Final Thoughts: One Envelope at a Time

Whether you’re using cash, an app, or a mix of both, the envelope system gives you clarity, control, and confidence in your finances. It’s a method that simplifies your budget and brings the whole family together around better habits.

So start with just a few categories. Stick with it. And let the system work its magic — one envelope at a time.